Did you know? Over 70% of mutual fund investors earn lower returns than the NIFTY 500 Index! But this doesn’t have to be your story. As we step into 2025, the best way to invest lies in choosing mutual funds tailored for long-term success. Whether you’re a beginner looking for the best beginners mutual funds or a seasoned investor, understanding how to select the best mutual fund can be the game-changer for your portfolio.

This guide will walk you through the top-performing options, why they’re excellent picks, and how to select funds based on data and strategy rather than following fleeting trends. Let’s make 2025 the year of smarter investments and long-term financial growth!

Best Mutual Funds for 2025

Investing in mutual funds is one of the most effective strategies for building long-term wealth. As we approach 2025, identifying the best mutual funds for your portfolio becomes essential for achieving your financial goals. Whether you’re looking for the best return mutual funds to maximize growth, debt mutual funds for stability, or the best equity mutual funds for higher returns, this guide will provide valuable insights. By making informed choices, you can optimize your investments and align them with your financial objectives, ensuring a well-balanced and rewarding portfolio.

Funds Overview: Top Picks for 2025

The mutual fund market provides a wide range of options tailored to varying risk appetites and investment objectives. Here are some of the best return mutual funds for 2025, known for their popularity and in consistency, making you think these funds would be excellent choices for your investment portfolio.

- Motilal Oswal Midcap Fund

- Nippon India Small Cap Fund / Motilal Oswal Small Cap Fund

- Nippon India Large Cap Fund

- Parag Parikh Flexicap Fund

- Kotak/ICICI Multicap Fund

If you’ve recently started investing in mutual funds, your portfolio may already include one or more of these top-performing funds.

How Were These Funds Selected?

These mutual funds are carefully chosen based on several key factors:

- Star Ratings: Platforms like Groww and Morningstar evaluate funds based on performance, risk, and consistency.

- Peer Recommendations: Recommendations from friends, financial advisors, and community discussions play a significant role.

- Performance Metrics: Metrics such as returns, alpha, and Sharpe ratio help highlight funds that outperform their benchmarks.

While historical performance is a common selection criterion, it’s essential to remember that past returns do not guarantee future success. For instance, Nippon India Small Cap Fund and Parag Parikh Flexicap Fund have delivered strong returns over the past seven years, but many funds demonstrate cyclical behavior.

Lessons from Past Performance

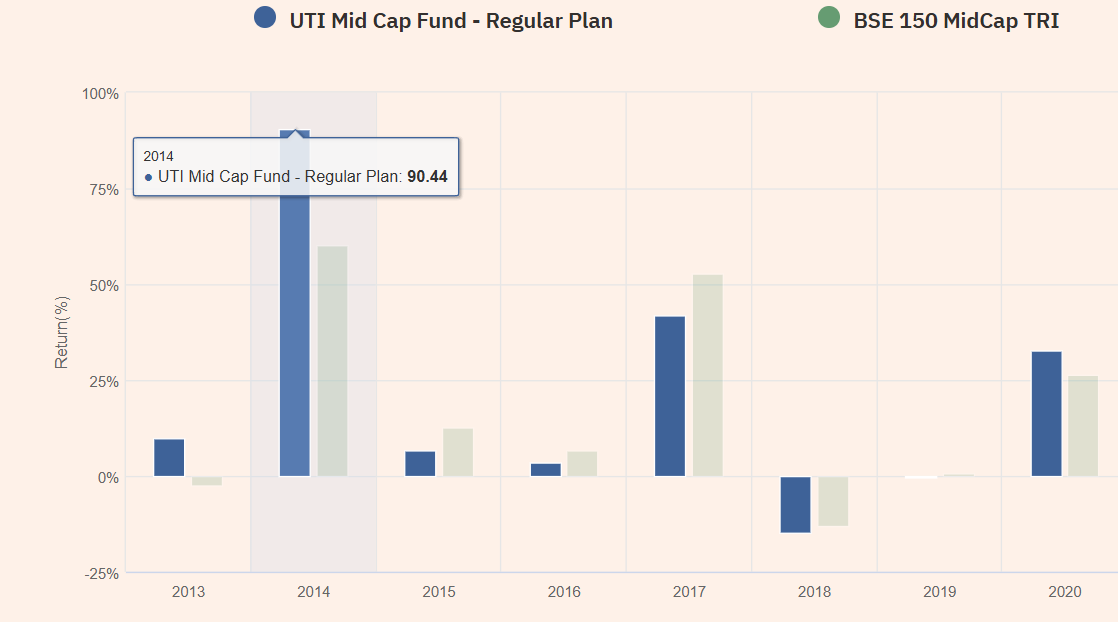

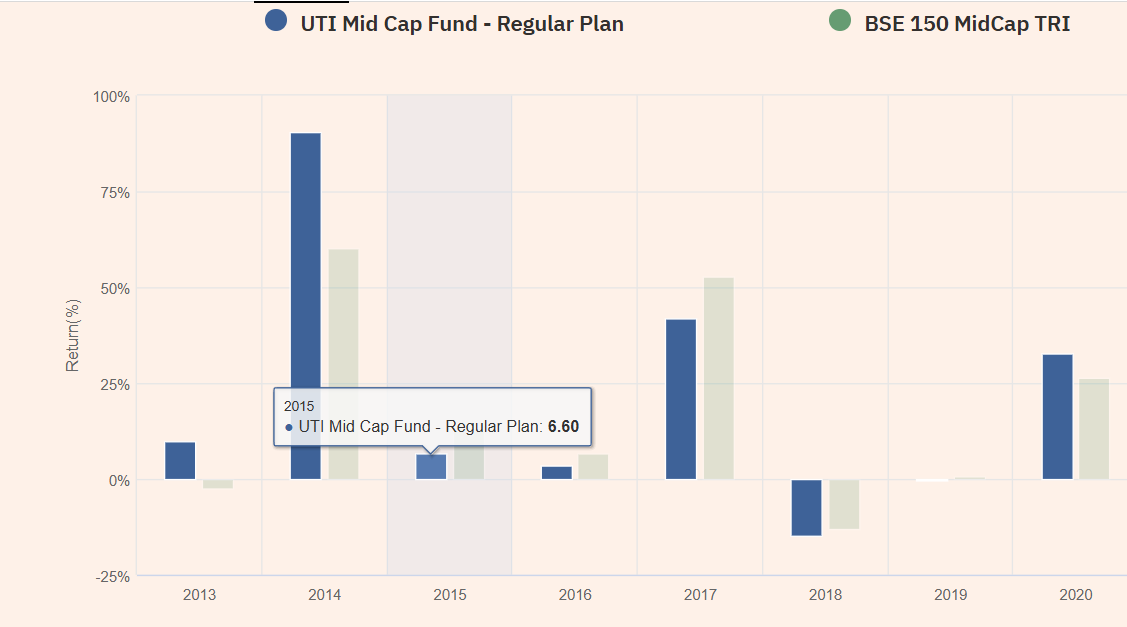

The cyclical nature of mutual fund returns highlights the importance of long-term consistency. Consider these examples:

- In 2014, UTI Midcap Fund achieved a stellar 78% return but fell to just 7.5% in 2015, ranking among the bottom five performers.

- In 2021, PGIM Midcap Fund delivered an impressive 92% return but underperformed in 2022 with -0.1%.

- In 2017, Bandhan Focused Equity Fund provided 85% returns, but in 2018, its performance dropped to -11.24%.

These cases emphasize the importance of avoiding short-term gains and focusing on funds with a track record of consistency.

Golden Rules of Mutual Fund Investing

When selecting the best mutual funds for 2025, adhere to these principles:

- Avoid Chasing Trends: Funds with high short-term returns often struggle to sustain their performance.

- Compare with Category Indices: Always ensure the fund consistently outperforms indices like NIFTY 500 or NIFTY Midcap 150 over the long term.

- Focus on Consistency: A fund delivering steady returns over a decade is more reliable than one with sporadic highs.

Additionally, SEBI regulations ensure reliability in mutual fund portfolios. For example, at least 65% of a flexicap fund’s portfolio must consist of the top 65 Indian stocks, providing a level of stability for investors.

Challenges with Active Funds vs. Index Funds

The debate between active and index funds is a critical consideration for investors. In India, up to 70% of actively managed funds underperform indices like NIFTY 500, underscoring the appeal of index funds.

- Active Funds: These funds rely on fund managers to pick stocks, but high management costs and inconsistent performance can hinder returns.

- Index Funds: These passive funds offer lower expenses and greater predictability by mirroring indices such as NIFTY 500 or NIFTY 50.

For Instance, last year, the top five active funds I recommended delivered a solid 21.71% return, outperforming the NIFTY 500 Index’s 18.50%. However, a pure index fund portfolio achieved an even better 23.33% return, highlighting the cost-efficiency and reliability of index funds.

Best Long Term Mutual Funds To Invest in 2025

1. Bandhan NIFTY 100 Index Fund (Direct Plan Growth)

Investing in long-term mutual funds is a reliable strategy for building wealth over time, and large-cap funds are a preferred choice for stability and steady returns. Among the standout options in the best large-cap category for 2025 is the Bandhan NIFTY 100 Index Fund (Direct Plan Growth).

This fund combines low costs, benchmark-aligned returns, and consistent performance, making it a top contender for those aiming to achieve financial growth over the long term.

Why Choose an Index Fund in the Best Large-Cap Category?

The Bandhan NIFTY 100 Index Fund mirrors the performance of the NIFTY 100 Index, which includes the top 100 companies in India by market capitalization. This index fund eliminates reliance on active fund managers, ensuring returns closely align with the market benchmark.

Key Advantages of Index Funds

Index funds like the Bandhan NIFTY 100 Index Fund offer several advantages that make them an appealing choice for investors. One of the most significant benefits is their ability to provide consistent benchmark-level returns. Over the last five years, 60% of large-cap funds have delivered returns lower than the NIFTY 100 Index.

In 2022 alone, an overwhelming 85% of large-cap funds underperformed the NIFTY 100 TRI Index, highlighting the reliability of passive index funds as a safer and more predictable investment option.

Another advantage is cost efficiency. With an expense ratio of just 0.09%, the Bandhan NIFTY 100 Index Fund minimizes cost leakage, allowing investors to retain a larger share of their returns compared to many actively managed funds.

Additionally, the fund’s tracking error is remarkably low at 0.05%, ensuring that its performance closely mirrors the NIFTY 100 Index with minimal deviation, providing investors with a transparent and dependable investment experience.

Why Use 5-Year Data Instead of 10-Year Data?

SEBI’s 2018 regulations brought significant changes to large-cap mutual funds. Before these rules, large-cap funds could include midcap stocks, which often boosted returns but increased risk.

Post-2018, SEBI mandated that large-cap funds allocate at least 85% of their portfolio to the top 100 companies, aligning these funds more closely with large-cap benchmarks and reducing risk.

Additionally, SEBI required funds to compare their performance with the Total Return Index (TRI), which accounts for dividends and bonuses.

This change provides a more accurate representation of profitability, making it harder for active funds to outperform their benchmarks. As a result, passive funds like the Bandhan NIFTY 100 Index Fund have gained traction among long-term mutual fund investors.

Fund Details and Performance

The Bandhan NIFTY 100 Index Fund offers simplicity and efficiency, delivering returns closely aligned with the benchmark at a fraction of the cost of active funds.

- Net Asset Value (NAV): ₹14.8 (as of December 2024)

- 1-Year Return: 91%

- Since Launch Return: 89% (CAGR)

These impressive metrics demonstrate the fund’s ability to generate consistent growth, making it an excellent choice for those seeking stability in the best large-cap category.

How SEBI Rules Improve Index Fund Transparency

SEBI's regulations have increased transparency in mutual funds. By mandating TRI comparisons and limiting large-cap funds to the top 100 companies, these rules ensure accurate performance data and discourage funds from inflating returns. The Bandhan NIFTY 100 Index Fund complies with these standards, offering reliability and reducing the risks of active fund underperformance.

Active Fund Alternative for Higher Risk Appetite

While the Bandhan NIFTY 100 Index Fund is ideal for passive investors, those seeking active management may consider the ICICI Prudential Bluechip Fund (Direct Growth). This fund focuses on blue-chip companies and has shown consistent outperformance over 2-3 year cycles, making it a suitable choice for investors willing to take slightly higher risks for potentially greater rewards.

2. SBI Large & Best Midcap Fund Direct Growth

When it comes to striking a balance between growth and stability, the SBI Large & Best Midcap Fund (Direct Growth) stands out as a top recommendation for 2025. This fund combines the stability of large-cap stocks with the growth potential of midcap stocks, making it an excellent choice for long- term investors.

With a proven track record, solid risk-adjusted returns, and consistent management, it has earned its place among the best-performing funds in this category.

Why Recommend This Fund for 2025?

The SBI Large & Best Midcap Fund has been a consistent recommendation for the past two years due to its strong historical performance and reliable fund management. This recommendation is backed by thorough research and data analysis.

In 2021, a comprehensive study of mutual funds from 1991 to 2021 involved detailed calculations of rolling returns, risk parameters, and other performance metrics. These insights revealed that this fund consistently outperformed its peers and benchmarks.

Key Metrics That Highlight Its Strength

1. Rolling Returns:

The fund has consistently delivered better rolling returns than its category index, showcasing its ability to perform across different market conditions.

2. Sharpe Ratio:

Its higher Sharpe ratio reflects superior risk-adjusted returns, meaning investors get higher returns for every unit of risk taken compared to the index.

3. Chance of Beating the Market:

Historical data shows that the fund has a greater likelihood of outperforming the broader market, providing long-term investors with a reliable growth trajectory.

Performance History and Management Excellence

Impact of Fund Management

A significant milestone in the fund’s history came in September 2017, when Saurabh Pant took over as fund manager, succeeding Jayesh Shroff. Since then, the fund has shifted towards a more stable and consistent performance pattern.

Unlike the pre-2017 era, where it delivered exceptionally high returns in one year but underperformed the next, the fund has maintained steady growth under Pant’s management.

Long-Term Performance

Between 2014 and 2016, the fund under performing least 2.75% more returns than the index over a five-year period. Post-2017, it has continued to generate consistent profits without major fluctuations, making it a dependable choice for investors.

Recent Performance Metrics

The SBI Large & Best Midcap Fund has demonstrated impressive returns over various timeframes, showcasing its strength as a long-term investment option.

1-Year Return: 21.36%

Over the last year, the fund has delivered robust returns, reflecting its ability to capitalize on short-term market opportunities while maintaining stability.

3-Year Return: 18.99%

The fund has sustained strong performance over three years, outperforming many of its peers in the large and midcap category.

5-Year Return: 22.07%

With over 22% annualized returns over five years, the fund has shown its capability to generate long-term wealth, even during periods of market volatility.

10-year Return: 16.19%

Its consistent 10-year performance demonstrates its resilience and long-term growth potential, making it a solid choice for patient investors.

What These Returns Indicate

The fund’s ability to deliver returns above 16% across timeframes showcases its balanced approach to risk and reward. The 5-year and 7-year figures are particularly noteworthy for long-term investors, as they highlight the fund's capacity to outperform during various market cycles.

Alternative Option: Kotak Equity Opportunities Fund

For investors seeking another option in the large and Best midcap category, the Kotak Equity Opportunities Fund is a reliable alternative. It offers similar diversification and performance metrics, making it a suitable choice for those looking to broaden their investment portfolio.

3. Parag Parikh ELSS Tax Saver Fund

The Parag Parikh ELSS Tax Saver Fund is one of the best tax saver funds for investors seeking to combine tax-saving benefits with long-term wealth creation. As an Equity Linked Savings Scheme (ELSS), it offers dual advantages: tax deductions under Section 80C of the Income Tax Act and the potential for significant returns.

With its disciplined approach and superior performance, this fund stands out as a top choice for low-risk mutual funds within the tax-saving category.

Why Prefer ELSS Funds Over Flexicap Funds?

ELSS funds like the Parag Parikh ELSS Tax Saver Fund are structurally advantageous, especially for lumpsum investment and long-term savings goals. Here’s why they are preferred over flexicap funds:

1. Consistent Outperformance

ELSS funds have a strong history of outperforming flexicap funds. Over the last five years, 21 out of 33 ELSS funds delivered returns above 20%, compared to only 19 out of 50 flexicap funds. The Parag Parikh ELSS Tax Saver Fund exemplifies this outperformance, delivering returns that consistently exceed market averages.

2. Stock Selection and Focus

Both ELSS and flexicap funds invest in a broad pool of stocks (top 1-500 companies). However, the mandatory three-year lock-in period for ELSS funds gives fund managers a long-term perspective. This reduces portfolio churn, ensuring stable returns and enabling better performance compared to other low-risk mutual funds.

3. Lower Expense Ratio

The Parag Parikh ELSS Tax Saver Fund maintains an expense ratio of 0.62%, slightly lower than its flexicap counterpart at 0.63%. Over time, this minor difference in expense ratio can have a significant impact, especially for best mutual funds for SIP and long-term investors.

4. Steady Outperformance Across Market Cycles

While flexicap funds may benefit from specific market trends, ELSS funds demonstrate resilience and consistent returns over varying market conditions. The Parag Parikh ELSS Tax Saver Fund, for instance, has consistently delivered steady performance, making it a top choice for lumpsum investments and SIPs alike.

Performance Metrics of Parag Parikh ELSS Tax Saver Fund

This fund has a proven track record, offering robust returns across multiple time horizons. Below are its performance metrics:

- 1-Year Return: 21.83%

The fund capitalized on favorable market conditions, delivering exceptional short-term growth. - 3-Year Return: 19.34%

Its three-year performance underscores its ability to navigate varying market scenarios effectively. - 5-Year Return: 24.49%

The fund’s five-year returns demonstrate its potential for long-term wealth creation, making it a preferred choice for retirement planning and other long-term goals.

What These Returns Indicate

The fund's performance reflects a balanced risk-reward approach, making it an excellent choice for low-risk mutual funds within the tax-saving category. Its returns, exceeding 20% across one, three, and five years, position it as one of the best mutual funds for SIP or lumpsum investment for achieving significant financial milestones.

Key Features of Parag Parikh ELSS Tax Saver Fund

The Parag Parikh ELSS Tax Saver Fund offers several key features that make it an attractive option for long-term investors. One of its primary benefits is the tax deduction under Section 80C of the Income Tax Act, allowing investments of up to ₹1.5 lakh to qualify for tax relief.

This feature makes the fund particularly appealing to salaried individuals and those aiming to optimize their tax liabilities. Additionally, the fund has a mandatory three-year lock-in period, ensuring that investments remain untouched during this time.

This lock-in enables the fund manager to focus on sustainable growth strategies, aligning with long- term financial goals while minimizing the impact of short-term market volatility. Furthermore, the fund maintains a diversified portfolio that spans various sectors and market capitalizations, providing a balanced risk-return profile.

By focusing on high-growth companies with strong fundamentals, the fund positions itself as a reliable choice for wealth creation and tax efficiency.

Why Choose Parag Parikh ELSS Tax Saver Fund?

The Parag Parikh ELSS Tax Saver Fund combines tax efficiency, consistent performance, and a diversified portfolio. It is ideal for:

- Best Mutual Funds for SIP: Its steady performance and low expense ratio make it a reliable option for systematic investments.

- Low-Risk Mutual Funds: For investors seeking lower risk with stable returns, the fund strikes a perfect balance.

- Lumpsum Investment: The three-year lock-in period ensures disciplined investing, making it suitable for one-time large investments.

With its superior track record and investor-friendly features, this fund stands out as one of the best tax saver funds for 2025, catering to both novice and seasoned investors aiming for wealth creation and tax benefits.

4. Nippon India NIFTY Midcap 150 Index Fund

Investing in midcap funds offers significant growth potential, but it comes with inherent challenges due to market volatility and sensitivity. The Nippon India NIFTY Midcap 150 Index Fund stands out as a top recommendation in the midcap category for 2025, offering consistent returns by tracking the performance of the NIFTY Midcap 150 Index.

This fund combines the advantages of index investing with exposure to some of India's fastest- growing companies, making it an ideal choice for long-term investors seeking high returns.

Why Recommend an Index Fund in the Midcap Category?

1. Consistent Outperformance of Index Funds

Active midcap funds often struggle to consistently outperform their benchmarks. Over the last five years, only 8 out of 24 active midcap funds managed to outperform the NIFTY Midcap 150 Index, emphasizing the difficulty of maintaining consistent outperformance in this category.

In contrast, the Nippon India NIFTY Midcap 150 Index Fund has delivered strong, benchmark-aligned returns, making it a safer choice for investors.

2. Volatility and Sensitivity

Midcap funds are inherently more sensitive to market conditions than large-cap funds. This volatility makes consistent outperformance by active managers challenging.

For example, while funds like HDFC Midcap Opportunities and Nippon India Growth Fund have delivered decent returns in the past, they still underperformed the NIFTY Midcap 150 Index, highlighting the reliability of passive index funds in capturing market performance.

3. Dependence on Market Performance

The returns of midcap funds are primarily driven by overall market performance. When the market delivers 18%-20% returns, midcap mutual funds tend to reflect similar growth. Without strong market performance, even the best active funds cannot generate high returns.

Index funds like the Nippon India NIFTY Midcap 150 Index Fund ensure that investors capture the market's full potential without relying on fund managers' strategies.

Performance Metrics of Nippon India NIFTY Midcap 150 Index Fund:

The Nippon India NIFTY Midcap 150 Index Fund has consistently delivered impressive returns, outperforming many of its active counterparts. Here’s a breakdown of its performance:

1-Year Return: 25.7%

Over the last year, the fund has leveraged market opportuniƟes to deliver robust growth, outperforming most acƟve midcap funds.

3-Year Return: 23.58%

The fund's three-year performance reflects its ability to generate sustained returns, aligning with the strong growth trajectory of midcap companies.

The fund’s ability to deliver over 20% annualized returns across one and three years highlights its efficiency in capturing market growth. These returns make it an attractive choice for investors with a higher risk tolerance, aiming for long-term financial goals.

Key Advantages of Nippon India NIFTY Midcap 150 Index Fund:

The Nippon India NIFTY Midcap 150 Index Fund offers several key advantages that make it an attractive choice for investors. By tracking the NIFTY Midcap 150 Index, the fund ensures that investors directly benefit from the market's performance without the unpredictability of active fund management.

This benchmark-driven consistency provides reliable, aligned returns that mirror the index. Additionally, the fund is highly cost-efficient, with lower expense ratios compared to actively managed funds.

This minimizes cost leakage, allowing investors to retain a larger share of their returns, which is especially beneficial for long-term investments. Furthermore, the fund provides exposure to 150 midcap companies across various sectors, ensuring a well-diversified portfolio that balances growth potential with risk management, making it an ideal option for those seeking steady, market-aligned growth.

Why Avoid Chasing Trending Funds?

Investors often chase funds with the highest recent returns, but this approach can lead to disappointment. For example:

The Motilal Oswal Midcap Fund delivered 60% returns last year, and the Invesco Midcap Fund generated 50% returns. However, these exceptional performances are rarely sustained, and such funds may fail to maintain their high ratings in subsequent

Instead of following trends, a disciplined investment in the Nippon India NIFTY Midcap 150 Index Fund offers long-term reliability and consistent outperformance of active counterparts.

5. Nippon India Nifty Smallcap 250 Index Fund

Small-cap funds are known for their potential to deliver extraordinary returns, particularly during bull markets. However, their inherent volatility demands a disciplined approach and a long-term perspective.

This article delves into the nuances of small-cap investing, its rewards and risks, and explores some of the best small-cap funds, including the Nippon India Nifty Smallcap 250 Fund, which has demonstrated notable returns.

The Potential and Volatility of Small-Cap Funds

Small-cap funds, as a category, have historically provided exceptional returns during market upswings. Their performance during bull runs often surpasses that of any other fund category.

For example, between 2004 and 2008, small-cap indices offered a staggering 550% return in just four years. Similarly, after 2020, the small-cap index achieved 489% returns in 4.5 years. However, these impressive returns come with significant unpredictability.

Historical Insights from the Nifty Small Cap 100 Index

A review of the Nifty Small Cap 100 Index over the years highlights its volatile nature:

- 2008-2024: The index grew from 1,273 to 18,666 over 16 years, yielding a CAGR of 18.27%.

- 2008-2016: The index remained almost flat, with a CAGR of just 0.14% over eight years.

- 2016-2018: A short bull phase saw the index grow at an impressive 53.37% CAGR in two years.

- 2018-2020: A sharp downturn followed, with the index losing 40.53% CAGR over two years.

These fluctuations underscore the importance of patience and a long-term vision when investing in small-cap funds.

Key Takeaways for Small-Cap Investors

Investing in small-cap funds requires a disciplined approach and a focus on the long term. These funds demand a long investment horizon, ideally 12 years or more, as their unpredictable nature makes them unsuitable for short-term goals. Small-cap funds can experience prolonged periods of underperformance, often testing the patience of even seasoned investors.

To mitigate risks, it is crucial to manage allocation wisely, ensuring that small-cap funds form only a balanced portion of your portfolio.

This diversification helps maintain overall portfolio resilience, even if small caps face extended periods of flat or negative returns. Additionally, having the right mindset is essential; investing in small caps is similar to buying land—returns may not materialize as expected in the short term. Patience and discipline are key to navigating market cycles and capitalizing on growth during favorable phases.

Best Small-Cap Funds to Consider

1. Bandhan Small Cap Fund

The Bandhan Small Cap Fund is a strong performer in the small-cap category, delivering consistent returns. It is a good option for investors willing to accept the high risk associated with small caps in exchange for potentially high rewards. A detailed analysis of this fund is available in a dedicated video, which provides deeper insights into its performance and portfolio strategy.

Performance Metrics:

1-Year Return: 44.06%

This fund has capitalized on recent market trends, delivering exceptional returns over the last year.

3-Year Return: 29.48%

Over three years, the fund has maintained consistent growth, outpacing many of its peers.

2. Edelweiss Small Cap Fund

The Edelweiss Small Cap Fund offers slightly lower returns compared to Bandhan but compensates with reduced risk. This makes it a suitable choice for investors seeking small-cap exposure with a more conservative risk profile.

Performance Metrics:

1-Year Return: 26.15%

The fund has delivered solid returns over the past year, reflecting its ability to perform in favorable market conditions.

3-Year Return: 23.83%

Consistently strong performance over three years highlights its reliability as a small-cap investment.

5-Year Return: 34.47%

Over five years, the fund has demonstrated exceptional growth, making it a reliable choice for long-term investors.

3. Nippon India Nifty Smallcap 250 Fund

The Nippon India Nifty Smallcap 250 Fund stands out as an index fund tracking the Nifty Smallcap 250 Index. Its passive investment approach ensures alignment with benchmark performance, offering a reliable option for small-cap exposure.

Performance Metrics of Nippon India Nifty Smallcap 250 Fund

The Nippon India Nifty Smallcap 250 Fund has demonstrated strong performance over the years, delivering the following returns:

1-Year Return: 25.27%

The fund has capitalized on recent market opportunities, delivering robust short-term growth.

3-Year Return: 21.93%

Over three years, the fund has sustained high growth, reflecting the broader market's strength in the small-cap segment.

What These Returns Indicate

The fund’s ability to deliver over 20% annualized returns across one and three years highlights its efficiency in capturing market growth during favorable conditions. These returns are particularly attractive for long-term investors with the patience to withstand volatility.

FAQs: Best Mutual Fund to Invest in 2025

1. What are the best mutual funds to invest in 2025?

The best performing mutual funds for 2025 include Bandhan NIFTY 100 Index Fund for large caps, Nippon India NIFTY Midcap 150 Index Fund for midcaps, and Parag Parikh Tax Saver Fund for tax-saving and long-term growth. Choose funds based on their growth or dividend options.

2. Why should I invest in mutual funds in 2025?

Mutual funds offer diversification and professional management, making them ideal funds to buy for navigating market volatility and achieving sector-specific growth. Funds with the best expense ratio ensure cost efficiency.

3. Who should consider investing in mutual funds for 2025?

Investors looking for wealth creation, tax savings, or a balance between growth or dividend income can benefit from funds across large-cap, mid-cap, and small-cap categories.

4. Where can I find reliable information about mutual funds for 2025?

Trusted platforms like SEBI, AMFI, and mutual fund apps provide details on best performing mutual funds, expense ratios, and fund comparisons to guide your choices.

5. How can I start investing in the best mutual funds for 2025?

Set up a SIP through reputable platforms, focusing on funds to buy that align with your financial goals and offer low expense ratios for maximum returns.

Conclusion:

The mutual fund industry in India is poised for growth, with systematic investment plans (SIPs) and diversified funds gaining traction among investors in the coming year. Flexi cap funds and sectoral funds are expected to perform well, offering opportunities to navigate market volatility.

With assets under management (AUM) reaching new heights, small-cap and equity mutual funds remain attractive for those looking to invest across large-cap and small-cap stocks. As inflows into equity mutual funds increase, financial literacy and awareness will empower investors to adopt balanced funds and multi-asset strategies, ensuring steady growth in 2025 amidst market trends.